The goal of climbing big, dangerous mountains should be to attain some sort of spiritual and personal growth, but this won’t happen if you compromise away the entire process.

― Yvon Chouinard, Let My People Go Surfing: The Education of a Reluctant Businessman

I get inspired reading about how others are building their companies (Let My People Go Surfing is one of my favorites). So I wanted to share one of Doist’s philosophies that I think has been central to our success as a remote company so far: don’t have an exit strategy.

This is an uncommon route for today’s high-growth tech startups to take. I believe the founders of the most important tech startups have built their companies without an exit strategy in mind.

Mission driven

No exit strategy means that we are not building our company around an exit. For us, the exit isn’t a priority or even a concern.

What’s better than an exit strategy? It’s a long-term mission that your company truly cares about. It’s focusing on building a company that can outlast you and creating something of true value. I believe this kind of thinking should be the guideline for every company.

At Doist our mission is to build tools for a more fulfilling way to work and live – tools like Todoist and Twist that are intentionally designed to help people and teams do more and stress less. We believe that when we do our jobs well, we enable people to achieve amazing things.

Bootstrapped and profitable

For a lot of companies, an exit can be forced, for example, by taking VC funding or debt on unfavorable terms where you lose control of the company. This is one of the reasons why Doist is bootstrapped and profitable: nobody can force us to exit or force us into a direction.

In 2009, I spoke with a famous Silicon Valley VC about a seed funding for Todoist . The first thing they wanted to do was to replace me as the CEO. Here’s an exact quote from the email exchange:

What I will need to figure out to get things rolling is who could be a “CEO” of the company who would present to my partners at a Monday meeting, be responsible for managing the finances, etc. X Y was the former CEO of a very successful X company and is a very energetic young and smart tech-savvy business guy. That said, he has his hands in a lot of projects right now and I don’t think he’d jump in and be the full-time CEO.

The seed round was set to be hundreds of thousands of dollars. A lot of money, especially given that Todoist was generating under $1,000 per month at the time, and I was only 24 years old. It would have been easy to accept this and let others control the destiny of my project. But I am pretty sure Todoist would have failed if I had pursued this route, since the other people were not as passionate about it as me . For them it was just another seed investment.

Most of today’s companies lose control early on and let outsiders dictate their direction. This works in some cases, but fails miserably in most. Outsiders simply don’t care about your mission, your product, or your people as much as you do.

The best companies, such as Google or Facebook, have taken funding and debt, but they never lost control by doing it.

While Doist might take funding at some point, we’ll never do it where we lose control. Losing control allows others to dictate where you should go, who you should hire, what your milestones are and what your exit plan should be.

Exit via an acquisition

We have been approached by large companies and we have declined even primary acquisition talks. The reason is simple: most acquisitions outright kill your company.

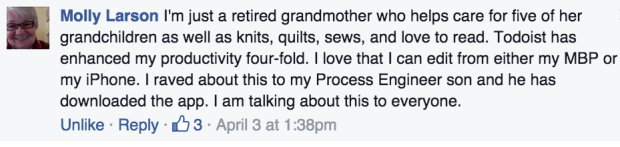

Sure, acquisitions are a way to make yourself and your team wealthy. But they are also a highly probable way to stop your mission. At Doist we simply don’t want to be a puppet of another company. We want to take our destiny in our own hands. For example, would a parent company care that their software is used by Molly Larson, a retired grandma? Probably not. But at Doist we care deeply about such cases.

Acquisitions should not be celebrated. They are an easy way out. What should be celebrated is building a meaningful company that focuses on the long term.

For example, Mark Zuckerberg could have accepted Yahoo’s $1 billion offer for Facebook. This would have made Facebook’s backers and employees incredibly wealthy. He declined, choosing to focuse on building a company that’s worth 250+ times more than that. He also changed the world by staying independent.

There are a lot of examples of acquisitions gone bad—many more than acquisitions gone great. A recent example of this is Parse, a cloud app platform that enabled developers to easily build backend services for their apps. Parse was acquired in 2013 by Facebook and shut down in 2016. Here’s a great quote by Charity Majors, an engineer from the Parse team:

You don’t own your product anymore. Your product is now “strategic alignment”. Look at yourself in the mirror and repeat that five times every morning. Your customers are not your customers anymore. Your customer is now your corporate overlord. You can resist this and try to serve your old customers first, but it will wear your engineering team out and eventually drive you mad.

For more of these check Our Incredible Journey, a collection of pre- and post-acquisition posts.

Exit via an IPO

Sometimes companies grow so large that they need to become public. The major problem of being a public company is that the stock market rewards short-term thinking and the stock dictates your direction. In other extreme cases, you can also end up in proxy wars with activist shareholders (check Carl Icahn’s history for brutal examples of this strategy).

It is possible to become a public company while preserving control, but it’s extremely rare. The best examples are Google and Facebook. The founders have a structure in place that gives them veto rights and lets them determine the direction. These structures enable these companies to focus on their long term missions. This is probably why both of these companies have been so successful, while others, such as Yahoo, have failed miserably.

Sustainable growth

It’s easy to see why people want an exit: growing startups is incredibly stressful and an exit (especially through an acquisition) is a fast way to end this stress and become wealthy in the process.

To solve the stress factor it’s important to focus on building a company and a company culture that’s sustainable. For example, not overworking people, not hiring too quickly, not overspending, having flexible vacations, etc. Basically, trying to create a company that promotes employee wellbeing and happiness.

At Doist we follow a few core guidelines:

- We care deeply about our people and their wellbeing. One stat we are very proud about is that, in Doist’s lifetime, only one person has left the company voluntarily. This is out of 40 people, which equates to a 97.5 percent retention over five years.

- We don’t over-hire or over-spend. We’re incredibly focused on hiring very smart people who fit into our culture. This is one of our top priorities.

- We have been bootstrapped from the beginning, only hiring people when we could afford it, when we needed it, and when we found the right candidates.

- We have European vacation days and people can take them whenever they want (25 paid days per year, excluding additional national holidays and sick days).

- People can work from anywhere they like and keep the hours that work best for them.

- We trust people by default. For example, we have implemented very few checks to ensure that people are “doing their work.” Great work is self-evident, and you don’t need to check for it. When we take the time to hire for the right cultural fit, we’ve found that we don’t have to have systems in place to look over people’s shoulders.

The Doist way

There are many ways to build a company, this is ours. I hope our philosophy inspired you and gave you another perspective on “exits.”

If you’d like to hear more about why we’re in it for the long haul, please check out my recent interview on the Productivityist podcast (around minute 32:30).

Finally, if our philosophy has resonated with you, and you’re interested in joining our team please check out our job openings.

Please don’t hesitate to reach out to me with questions or comments below.